Lend, Borrow, Grow

A peer-to-peer lending platform with secure transactions and quick loan access. Check your CIBIL score, gain financial insights, and track your budget seamlessly.

Get Started with 3 Simple Steps

Join CALQUE today and unlock easy, efficient, and secure financial solutions in just a few clicks.

Step-01

Signup

Create your account using your email or social media profiles in just a few minutes.

Step-02

Video KYC

Complete the KYC process for secure and compliant transactions.

Step-03

Lending or Borrowing

Access loans quickly or lend to earn fixed returns.

Empower Your Financial Journey

Unlock seamless lending and borrowing with our intuitive platform.

Interest-Earning Lending

Lend money to trusted individuals and earn up to 12% interest on your loans. CALQUE’s secure platform ensures your investment is both profitable and protected.

Credit and Purchase Power

Gain immediate access to funds based on your financial background. CALQUE provides flexible credit limits, empowering you to make purchases when you need them most.

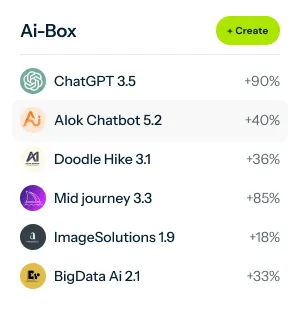

The Most Powerful System for Peer-to-Peer Lending

Discover how Calque provides various cutting-edge features with improved efficiency.

Peer-to-Peer Lending

Easily lend and borrow among friends, family, and contacts with built-in monitoring and reminders.

Interest Earning

Grow your wealth by earning up to 12% interest on loans to individuals outside your network.

Credit Power

Access flexible credit limits tailored to your financial background for immediate purchasing needs.

Deposits and Security

Secure your funds with CALQUE and earn interest on your deposits with complete peace of mind.

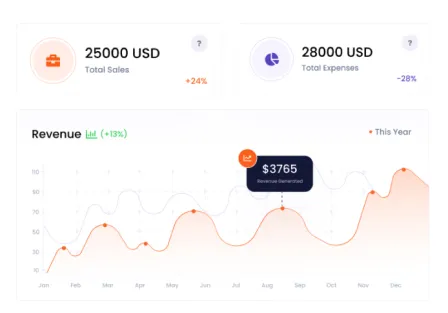

Transaction Analysis

Gain insights into your spending habits with detailed transaction history and monthly analysis.

CIBIL Score Education

Understand and improve your creditworthiness with educational resources on CIBIL scores.

Maximize Your Financial Potential

Innovative features to enhance your lending and borrowing experience.

- User Friendly Interface

- Real-time Alerts

- High Returns

- Flexible Limits

Unlock Financial Freedom with CALQUE's Financial Solutions

Experience unparalleled financial flexibility and security tailored to your needs.

Get Loans Instantly

Apply for loans and receive funds in no time. Our streamlined process ensures that you have access to the money you need without lengthy wait times.

Tailored Repayment Plans

Choose from various repayment options that suit your financial situation. We offer flexibility to make your loan repayment as manageable as possible.

Trustworthy and Secure

Our platform uses advanced security measures to protect your transactions and personal information, ensuring a safe lending and borrowing environment.

Frequently Asked Questions

Explore this section to learn more about our AI chatbots and find answers to your questions.

Applying for a loan on CALQUE is simple. Create an account, complete your profile, and navigate to the loan application section. Fill in the required details and submit your application. Our system will process your request, and you'll get a response as soon as possible.

You can earn up to 12% interest on loans made to individuals outside your immediate network. The exact rate depends on various factors, including the borrower's creditworthiness and the loan terms. Our platform ensures your investment is secure and offers competitive returns.

CALQUE uses advanced encryption and security protocols to protect your financial transactions. We also monitor all activities for suspicious behavior and provide secure authentication methods to safeguard your account. Your data and funds are always protected with us.

We offer flexible repayment options tailored to your financial situation. You can choose from various plans, including monthly installments or lump-sum payments, depending on what suits you best. Our goal is to provide you with convenient and manageable repayment terms.

Our transaction analysis feature provides detailed insights into your spending habits. By accessing your transaction history with your bank's permission, we analyze your expenditures and show you a monthly breakdown. This helps you identify spending patterns and manage your budget more effectively.

A CIBIL score is a numerical representation of your creditworthiness, based on your credit history. It ranges from 300 to 900, with higher scores indicating better credit health. Understanding your CIBIL score helps you make informed financial decisions, access better loan terms, and improve your credit standing. Our platform educates you on how to maintain and improve this crucial score.

We Just Released the App! Get It Now

Experience seamless lending and borrowing today. Download the app from the Play Store or App Store and start your financial journey.

Company

Quick Links